Today, we’re going to discuss how to correct it.

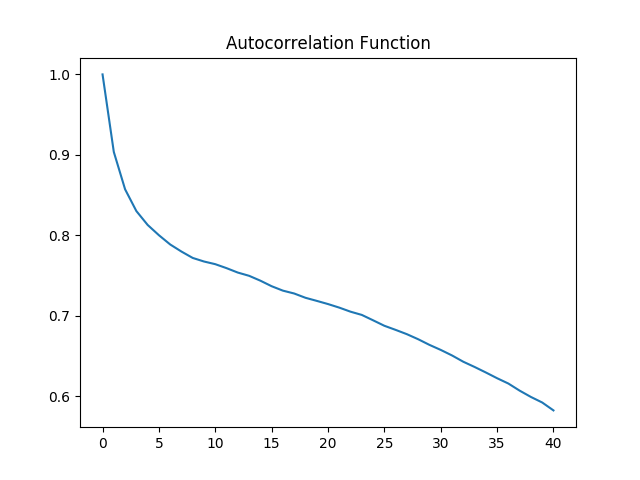

In last week’s Forecast Friday post, we showed you how to diagnose autocorrelation: examining the model’s parameter estimates, visually inspecting the data, and computing the Durbin-Watson statistic. As a result, your model generates forecasts that are too good to be true and has a tendency to miss turning points in your time series.

Models exhibiting autocorrelation have parameter estimates that are inefficient, and R 2s and t-ratios that seem overly inflated. Last week, we discussed how to detect autocorrelation – the violation of the regression assumption that the error terms are not correlated with one another – in your forecasting model.